•

Start of a shallow rate cycle

post February cuts.

• Investors should add duration

with every rise in yields, as

yield upside limited.

•

Mix of 10-year maturity and 1-

5-year corporate bonds are

best strategies to invest in the

current macro environment.

•

Selective Credits continue to

remain attractive from a risk

reward perspective given the

improving macro fundamentals.

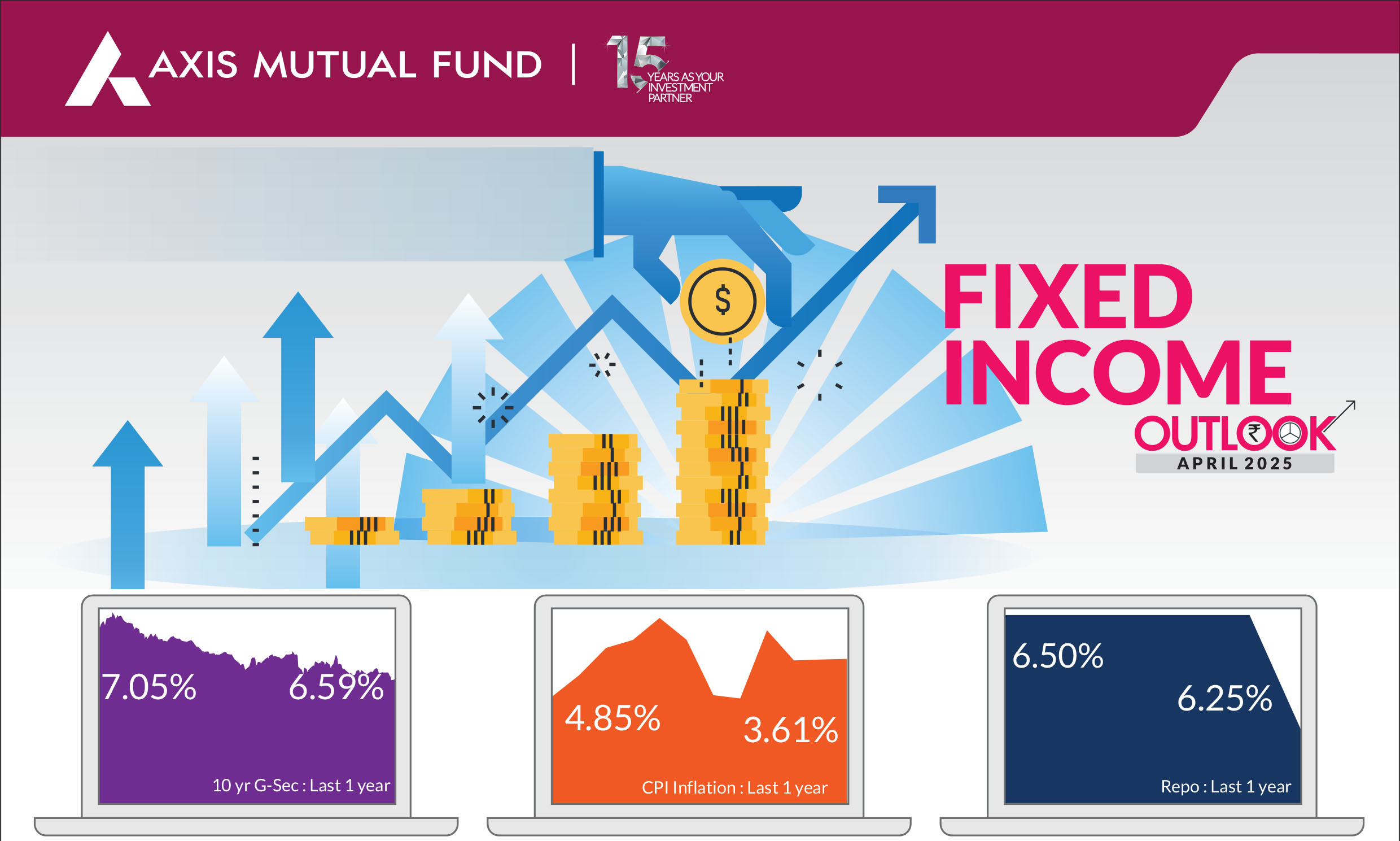

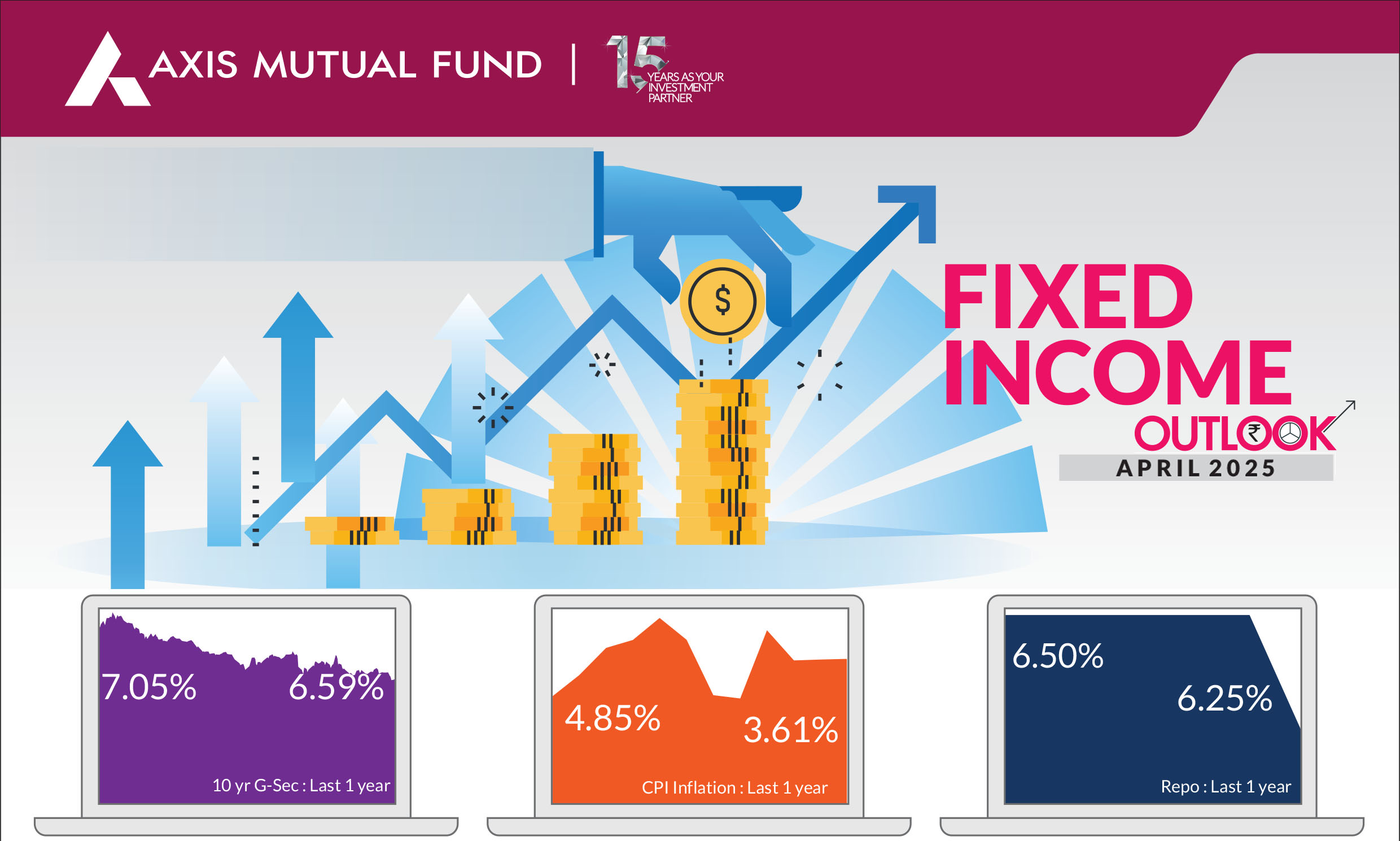

After a fall in February, US Treasury yields ended flat in March amid concerns over the impending US slowdown as a result of the tariffs implemented by the US. In India, the 10-year government bond yields fell 13 basis points given liquidity infusion by the central bank, receding inflation numbers and expectations of interest rate cuts.

RBI infuses liquidity, could lower rates :

The central bank is infusing liquidity into

the system by way of open market operations (OMOs) worth Rs 80,000 cr. This will

be carried out in four tranches of Rs 20,000

crore each, on April 3, April 8, April 22 and

April 29. This would take cumulative OMO

purchases by the RBI in 2025 to INR

3,300bn. Earlier in March, it conducted

OMO purchases of government securities

worth Rs 1 lakh crore in two tranches of Rs

50,000 crore each. The central bank also

held a dollar-rupee buy/sell swap auction of

$10 billion for 36 months. All eyes are towards the monetary policy on April 9,

wherein the Reserve Bank of India is expected to lower interest rates by 25 basis

points.

Meanwhile, FY25 ended with a banking liquidity surplus of Rs 894 billion due to a notable liquidity infusion of Rs 3.2 trillion, along with government spending and recent FPI inflows.

Meanwhile, FY25 ended with a banking liquidity surplus of Rs 894 billion due to a notable liquidity infusion of Rs 3.2 trillion, along with government spending and recent FPI inflows.

Inflation falls below 4% :

Headline inflation fell to 3.6% in February from 4.3% in

January 2024, led by a faster than expected moderation in food prices especially

vegetables with the onset of winter months. Core inflation continues to remain

below 4% for over 12 months. We anticipate headline inflation to remain low due to

good rabi and kharif crop harvests and lower vegetable prices.

Rupee appreciates in March : The rupee appreciated approx. 2.4% in March vis a vis the US dollar on account of foreign inflows in the latter part of March and a weaker dollar itself which lost ground against most currencies. We expect the rupee to stabilize in the near term.

US treasury yields unchanged in March : While yields fell from mid February, March turned out to be relatively flat. Investors maintained a cautious stance towards the reciprocal tariffs being implemented and the invariable slowdown that the US could face.

Tariffs imposed on Indian exports could marginally slow growth : Reciprocal tariffs were announced by the US government across countries with tariff on India being 26% which means all goods entering the US will now attract a minimum 26% levy effective April 9, 2025. The impact on India's exports may be muted in near-term but global growth and trade slowdown will be negative for India over the medium-term.

Rupee appreciates in March : The rupee appreciated approx. 2.4% in March vis a vis the US dollar on account of foreign inflows in the latter part of March and a weaker dollar itself which lost ground against most currencies. We expect the rupee to stabilize in the near term.

US treasury yields unchanged in March : While yields fell from mid February, March turned out to be relatively flat. Investors maintained a cautious stance towards the reciprocal tariffs being implemented and the invariable slowdown that the US could face.

Tariffs imposed on Indian exports could marginally slow growth : Reciprocal tariffs were announced by the US government across countries with tariff on India being 26% which means all goods entering the US will now attract a minimum 26% levy effective April 9, 2025. The impact on India's exports may be muted in near-term but global growth and trade slowdown will be negative for India over the medium-term.

Market view

We expect an overall shallow interest rate cut cycle of 25-50 bps in next 6-12 months with 25 bps coming up in the April monetary policy meeting and a long pause thereafter. As mentioned earlier, the central bank proactively managed liquidity infusion to anchor the overnight rates to the policy rates. Despite rate cut and slew of liquidity measures, short end CDs and 3-5 year corporate bond yields have hardened and spreads have widened due to higher supply. OMO purchases and measured supply in Govt bonds have led G-Sec yields to rally by 5-10 bps. We believe that the liquidity infusion has been more than sufficient to ensure Core liquidity remains in surplus in near term. Core/durable liquidity has shifted from a deficit of INR 1 trillion in Dec to a surplus of INR 1.5 trillion by March 25 and is expected to be above INR 2.5 trillion by Sept 2025. Announcement of RBI dividend by June 2025 of INR 2.5 trillion would be another big boost to core / durable liquidity and hence we believe core/ durable liquidity to remain in surplus from April 2025 for H1 FY 2025- 26. Positive liquidity augurs well for short end of the curve and we expect the curve to get steeper over the next 6 months as compared to flat/invert yield curve.In the US, we believe rate cuts could be to the tune of 50-75 basis points. Growth is indeed slowing down as seen by the weaker data such as GDP growth, lower inflation and other macros. The tariff measures implemented by the US on its top trading partners will hurt growth over the medium term.

Risks to our view: The risks to our view at this point are as below

1) Currency risk

2) Trade wars

Strategy - We have been maintaining a higher duration across all our funds and guiding the rally in bonds since March 2024. We have already witnessed more than 50 bps of rally in 10-year bonds since early 2024 but positive demand-supply dynamics for government bonds and expected rate cuts will continue to keep bond markets happy, and we can expect another 20-25 bps of rally in the next 3-6 months. Directionally we see yields for the 10-year Gsec to trade in a range of 6.25%-6.40% in the next 6 months.

We anticipate that the RBI will maintain its emphasis on ensuring positive system liquidity going forward. Due to favourable demand supply dynamics and OMOs, we continue to have a higher bias towards government bonds in our duration funds.

Going forward, we believe it's time to add 1-5 year corporate bonds to the portfolio as we expect surplus banking liquidity, lower supply of corporate bonds/ CDs due to slowdown and delay in implementation of LCR guidelines and attractive spreads and valuations. Incrementally short bonds can outperform long bonds from risk riskreward perspective due to a shallow rate cut cycle, lower OMO purchases in the second half of the year and a shift in focus to Govt Debt to GDP targets.

What should investors do?

• In line with our core macro view, we continue to advise short- to medium-term funds with tactical allocation of gilt funds to our clients.

Source: Bloomberg, Axis MF Research.